The weed delivery market is experiencing a meteoric rise, but as we approach 2026, a one-size-fits-all approach is a surefire way to get left behind. Imagine pouring all your marketing budget into a campaign targeting the stereotypical “stoner,” only to discover your most loyal customer is actually a 45-year-old professional using cannabis for sleep. This is the reality of today’s market.

Market segmentation insights 2026 are no longer a luxury for cannabis businesses; they are a survival tool. The industry is fracturing into distinct consumer groups with unique needs, preferences, and buying behaviors. Understanding these segments is the key to unlocking explosive growth, building brand loyalty, and dominating your local or regional landscape. Are you ready to move beyond guesswork and start making data-driven decisions that connect with the right customers?

In this comprehensive guide, we’ll dive deep into the cannabis delivery service market segmentation, providing you with the actionable insights needed to craft a winning strategy for the coming year.

What is Market Segmentation and Why Does it Matter for Weed Delivery?

At its core, market segmentation is the process of dividing a broad consumer or business market into sub-groups of customers based on shared characteristics. For weed delivery services, this isn’t just an academic exercise—it’s the blueprint for efficient operations and effective marketing.

Why is segmentation critical for your delivery business in 2026?

- Precision Marketing: Stop wasting ad spend. Target medical patients with messages about specific therapeutic benefits, while appealing to recreational users with convenience and novel product experiences.

- Product Development: Understand which segments are driving demand for pre-rolls, beverages, or tinctures, allowing you to optimize your inventory and partnerships.

- Enhanced Customer Experience: Tailor your website, app, and delivery options to meet the specific expectations of each group. A medical patient values reliability and discretion, while a recreational user might prioritize speed and a wide selection.

- Competitive Advantage: In a crowded market, the business that knows its customers best wins. Segmentation allows you to identify and dominate a profitable niche before your competitors even see it.

The 2026 Market Landscape: Size, Growth, and Key Drivers

To appreciate the power of segmentation, we must first understand the massive canvas we’re working on. The global cannabis market is on a staggering upward trajectory. Industry projections indicate worldwide sales could reach approximately $61 billion by 2026, representing a compound annual growth rate (CAGR) of over 16%. The United States, the dominant force, is projected to see sales grow from $25 billion in 2021 to $42 billion by 2026.

Within this boom, the cannabis delivery service market is a standout segment. Valued at approximately $2.95 billion in 2024, it is projected to reach a staggering $18.65 billion by 2033, reflecting a CAGR of 20.3%. This growth is fueled by several key drivers that every business owner must understand:

- Legalization Momentum: The state-by-state legalization in the U.S. and similar movements in countries like Germany and Thailand are continuously expanding the addressable market.

- Consumer Preference for Convenience: A seismic shift towards digital-first shopping means consumers now expect the same seamless delivery experience they get from Amazon. Surveys show 75% of consumers want easy reordering capabilities for cannabis.

- The Wellness Revolution: The stereotype of cannabis as a mere recreational substance is dead. Today, 64% of consumers cite relaxation as their primary motivation, signaling a massive shift towards wellness-driven demand.

Deep Dive: Core Segmentation Models for Weed Delivery Services

Let’s break down the market using the most critical segmentation models. Think of these as different lenses to view your customer base.

1. Segmentation by Service Type

This is one of the most fundamental ways to categorize your delivery operations.

- Medical Cannabis Delivery: This segment is the revenue backbone, accounting for 45% of total delivery market revenue. It’s driven by registered patients who value reliability, specific product efficacy, and discretion. Retention rates in this segment can exceed 80%.

- Recreational (Adult-Use) Delivery: This is the high-growth, volume-driven segment. It caters to consumers seeking convenience, variety, and often, faster delivery times.

- Same-Day vs. Scheduled Delivery: Same-day delivery services saw a 35% year-over-year increase in demand, highlighting the consumer’s desire for instant gratification. Scheduled delivery, however, remains crucial for medical patients who plan their medication regimen.

2. Segmentation by Platform Type

How customers order is as important as what they order.

- Mobile Applications: This is the dominant platform, capturing 65% of all delivery orders. Apps win with user-friendly interfaces, real-time tracking, and integrated payments, leading to conversion rates 35% higher than web platforms.

- Web Platforms: Still essential for discovery, research, and catering to customers who prefer browsing on a larger screen. A robust, SEO-optimized website is your digital storefront.

3. Segmentation by End User

Who is actually placing the order?

- Individual Consumers: The broad category encompassing both medical patients and recreational users.

- Medical Patients: A dedicated subset with specific needs, often supported by insurance frameworks in some regions.

- Licensed Dispensaries (B2B): A growing segment! Partnerships between delivery platforms and dispensaries grew by 55% in 2023, indicating a robust wholesale and logistics opportunity.

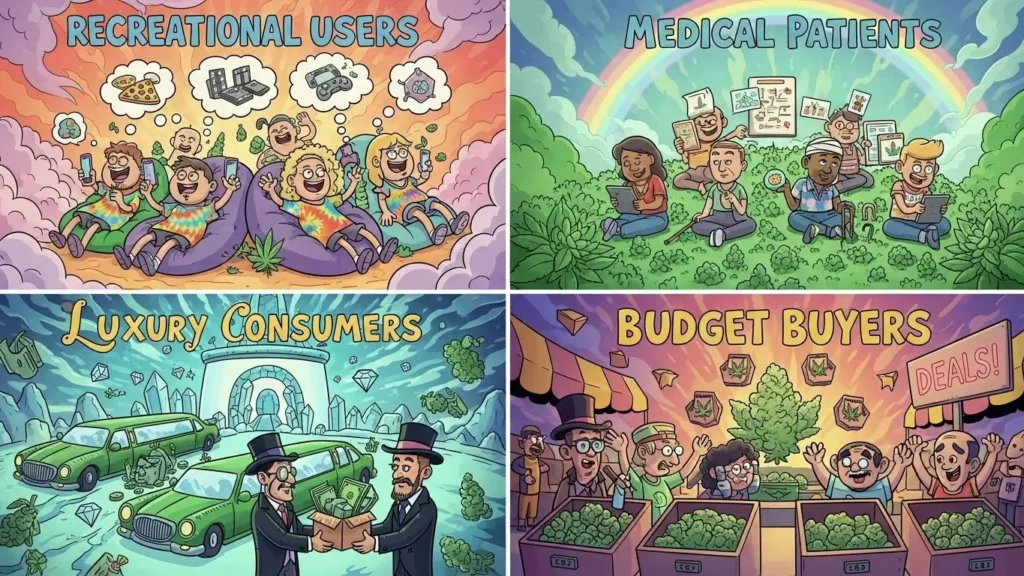

Beyond the Basics: Advanced Consumer Segmentation for 2026

While service and platform segmentation tells you what and how, advanced consumer segmentation tells you who and why. This is where true marketing magic happens.

Demographic Segmentation: The “Who” is Changing

Forget the outdated stereotype. The modern cannabis consumer is diverse.

- Gender: Women now compose more than half of cannabis users and skew heavily towards wellness products like topicals and edibles.

- Age: Millennials and Gen Z together drive 63% of total U.S. cannabis spending. Meanwhile, middle-aged adults (35-54) are increasingly identifying as consumers as stigma fades.

- Income & Education: The consumer base is broadening across socioeconomic lines, with a significant segment of high-income, educated professionals seeking quality and specific effects.

Psychographic Segmentation: The “Why” is Evolving

This groups people by attitudes, aspirations, and lifestyles.

- The Wellness Seeker: Their primary goal is relaxation, sleep aid, or pain management. They are interested in minor cannabinoids like CBN and CBG and prefer discreet, controlled-dose formats like edibles or tinctures.

- The Recreational Connoisseur: Focused on experience, flavor, and social use. They might seek out novel product formats like infused beverages or craft pre-rolls.

- The Health-Conscious Consumer: Prioritizes organic sourcing, sustainable growing practices, and clean ingredients. They are rejecting mediocre products for flavorful, residue-free options.

Behavioral Segmentation: Understanding Actions

This looks at purchasing patterns, usage rates, and brand loyalty.

- Usage Rate: Segment into light, medium, and heavy users. Your loyalty program for a heavy user will look very different from your onboarding for a first-time customer.

- Benefit Sought: Is the customer buying for pain relief, social anxiety, creativity, or sleep? Tailor your product descriptions and recommendations accordingly.

- Brand Loyalty: Nearly nine in ten consumers return to brands that offer personalized recommendations. Behavioral data allows you to identify and reward your most loyal segments.

Geographic Segmentation: Location, Location, Location

- Region: North America holds 50-60% of the global market share, with California alone representing 30% of U.S. delivery revenue. The Asia-Pacific region, however, is expected to show the fastest CAGR.

- Urban vs. Rural: Urban areas have higher population density and competition. Rural areas represent a significant opportunity, as 20% of the medical cannabis patient population is currently underserved by delivery services.

Strategic Implications: Turning Insights into Action for 2026

Data is useless without action. Here’s how to apply these weed delivery market segmentation insights to your 2026 strategy:

- Audit Your Data: Use your POS, website analytics, and customer feedback to identify your current customer segments. Who are they really?

- Refine Your Messaging: Create distinct marketing campaigns. Speak to the Wellness Seeker about “restorative sleep” and to the Connoisseur about “terpene profiles and craft experiences.”

- Personalize the Digital Journey: Implement recommendation engines on your app/website. “Customers who bought this CBN oil for sleep also liked this lavender topical.”

- Optimize Your Service Tiers: Consider offering a premium, subscription-based delivery service for medical patients (scheduled, reliable) and a fast, on-demand option for recreational users.

- Target Geographically: If you’re in a competitive urban market, compete on hyper-local service and niche products. If you’re near rural areas, consider expanding your delivery radius to capture an underserved market.

Conclusion: The Segmented Path to Dominance

The cannabis delivery service market segmentation landscape for 2026 is complex, dynamic, and incredibly promising. The businesses that will thrive are those that move beyond viewing their market as a monolith. By deeply understanding the different segments—from the medical patient relying on scheduled deliveries to the Gen Z consumer ordering a THC beverage on their phone—you can allocate resources efficiently, build unshakeable loyalty, and capture disproportionate market share.

The question is no longer if you should segment your market, but how quickly and how effectively you can do it. The insights are here. The data is clear. The time to act is now.

Ready to build a delivery service that truly resonates with your target audience? Start by auditing your current customer data today and map them against the segments we’ve outlined. The road to 2026 leadership begins with a single, insightful step.

Frequently Asked Questions (FAQs)

What are the main types of market segmentation for a weed delivery business?

The main types include:

- Service Type: Medical vs. Recreational, Same-day vs. Scheduled.

- Platform Type: Mobile app users vs. Web browser users.

- Demographic: Age, gender, income.

- Psychographic: Lifestyle and values (e.g., Wellness Seeker vs. Connoisseur).

- Behavioral: Purchasing habits, brand loyalty, benefits sought.

- Geographic: Regional, urban vs. rural markets.

Why is the medical cannabis delivery segment so dominant?

The medical segment accounts for about 45% of delivery revenue because it serves patients with chronic conditions who have high retention rates (over 80%) and often rely on delivery due to mobility issues or the essential nature of their medication.

How are consumer demographics shifting in the cannabis market?

The demographics are broadening significantly. Women now make up more than half of cannabis consumers, and the spending power is concentrated with Millennials and Gen Z, who drive 63% of total U.S. sales. The consumer base is becoming older, more female, and more wellness-oriented.

What is the single biggest consumer trend affecting segmentation in 2026?

The shift from recreation to wellness is the overarching trend. With 64% of consumers citing relaxation as their main goal, businesses must segment and target the “Wellness Seeker” with products and messaging focused on specific outcomes like sleep, stress relief, and pain management.

How important is mobile app development for a delivery service?

It’s critical. Mobile applications are the preferred method, capturing 65% of all delivery orders. They offer better user engagement, higher conversion rates, and features like real-time tracking that are now customer expectations.